Trading strategy

Basic concepts and terms

We can highlight the following terms and concepts that are necessary to describe the strategy

- The strategy is considered on the example of cryptocurrency trading, although it can be applied to the stock market and forex

- Examples on BTC/USDT trading pair

- Start point - a point in time and a rate corresponding to it, at which a trading grid is built, the initial sums are determined and initial orders are placed

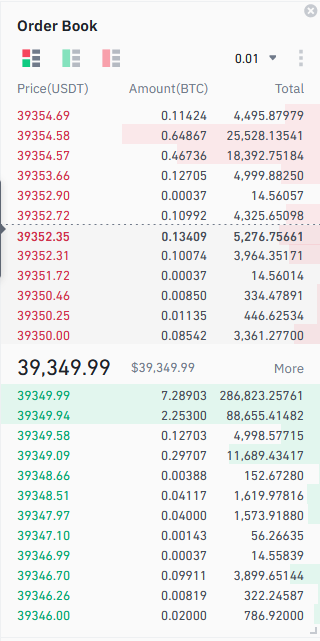

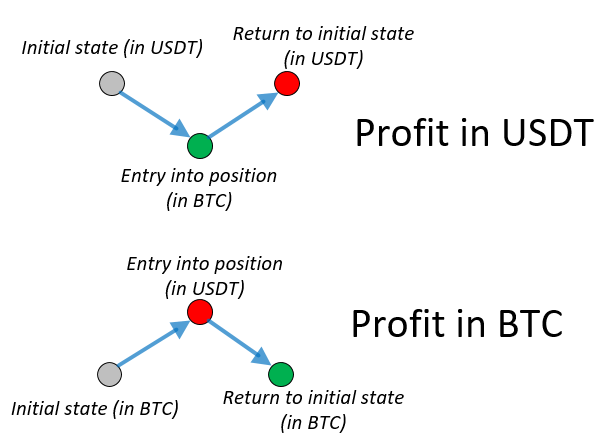

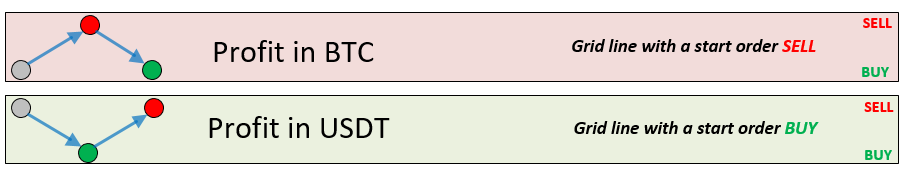

- SELL - sell orders and trades, are shown in red.

- BUY - orders and trades to buy, they are shown in green

Basic concepts of exchange trading

- An order is an offer to buy or sell a given amount of coins. Whoever places the order is called a Maker

- A trade is an order accepted by some trader. Whoever accepts (agrees to the price and volume) the order is called a Taker

- The order may be filled partially (a portion of the amount)

- The exchange is responsible for execution of a trade according to the order book. The nearest (most profitable) prices on the order book are selected when performing a deal.

Basic principle

The basic principle of the grid trading strategy is simple: sell more expensive than you buy or buy cheaper than you sell.

In this case the profit is formed only from a couple of trades:

Strategy variants

Let's consider the case where we only have start-up capital in USDT. We can:

- Place buy only start orders (BUY)

- Exchange all of the USDT for BTC at the current market rate and place SELL orders only

- Exchange part of USDT for BTC at the current market rate and place Buy (BUY) and Sell (SELL) start orders

Grid line (row)

The grid line is the range of prices at which the buying and selling takes place. Each grid line is characterized by the following parameters:

- Buy price

- Sale price

- Width - as a ratio of the selling price to the buying price expressed as a percentage

- Type of a start order (SELL or BUY)

- Amount of the start order

The grid of orders

The grid of orders is a set of grid lines.

It is important to understand that the width of the step should be greater than double the size of the fee, because 2 trades are required to make a profit, and the exchange fee will be paid on each of them.

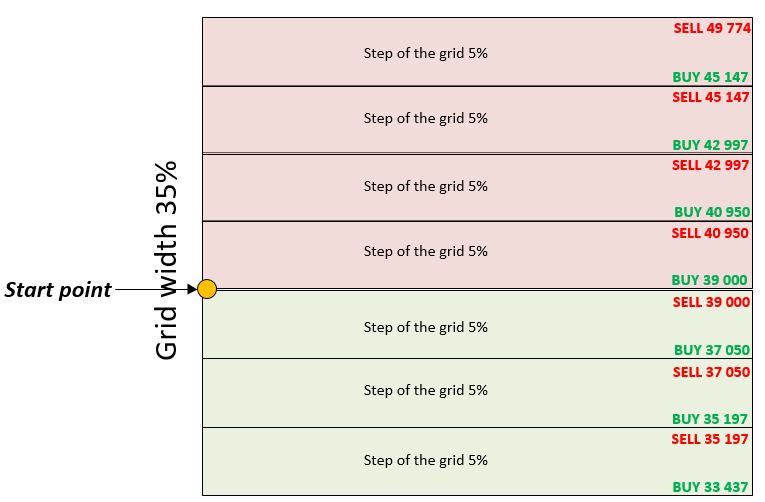

For example, a grid with a step of 5% from the starting point of 39,000 would look like this:

The grid may not be full coverage, but it may be gaps.

Building the grid

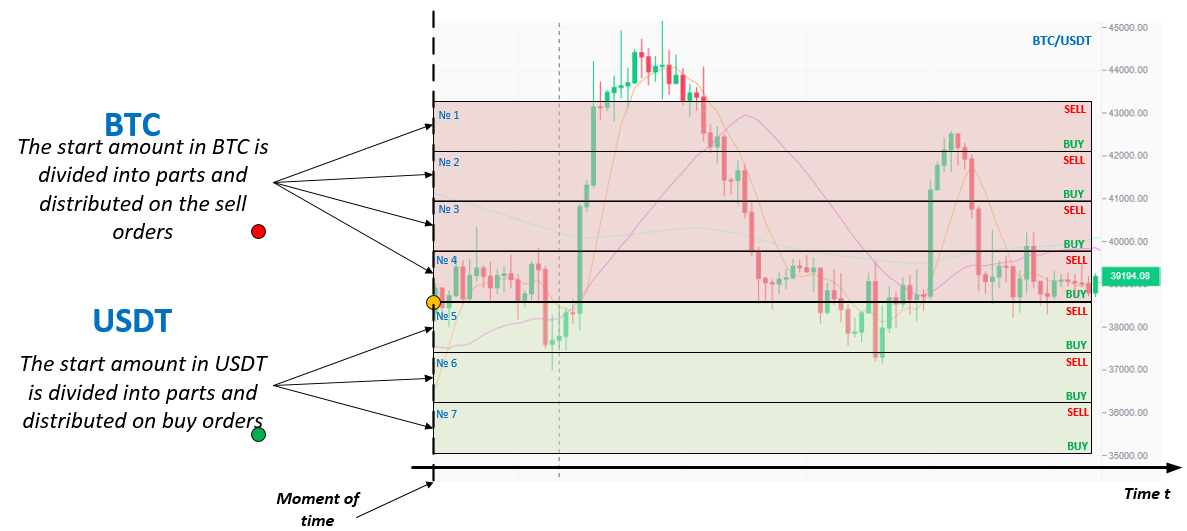

Let's consider a fragment of the BTC/USDT rate chart. Suppose we are at the starting point:

From this point, we will build a grid of orders up and down. It is important to understand that, being at this point in time, we do not know how the currency rate will behave in the future, and the chart in the example is given for demonstration of the strategy's mechanics.

Suppose we have amounts in two currencies in USDT and in BTC, then:

- Split the amount in BTC into several parts and place SELL orders

- Split the amount in USDT into several parts and place BUY orders

Let's distribute the starting amounts by grid lines and place starting orders:

- On lines 1-4 - to sell BTC at the corresponding selling rate

- On lines 5-7 - for buy BTC at the corresponding bid rate

Rate change simulation

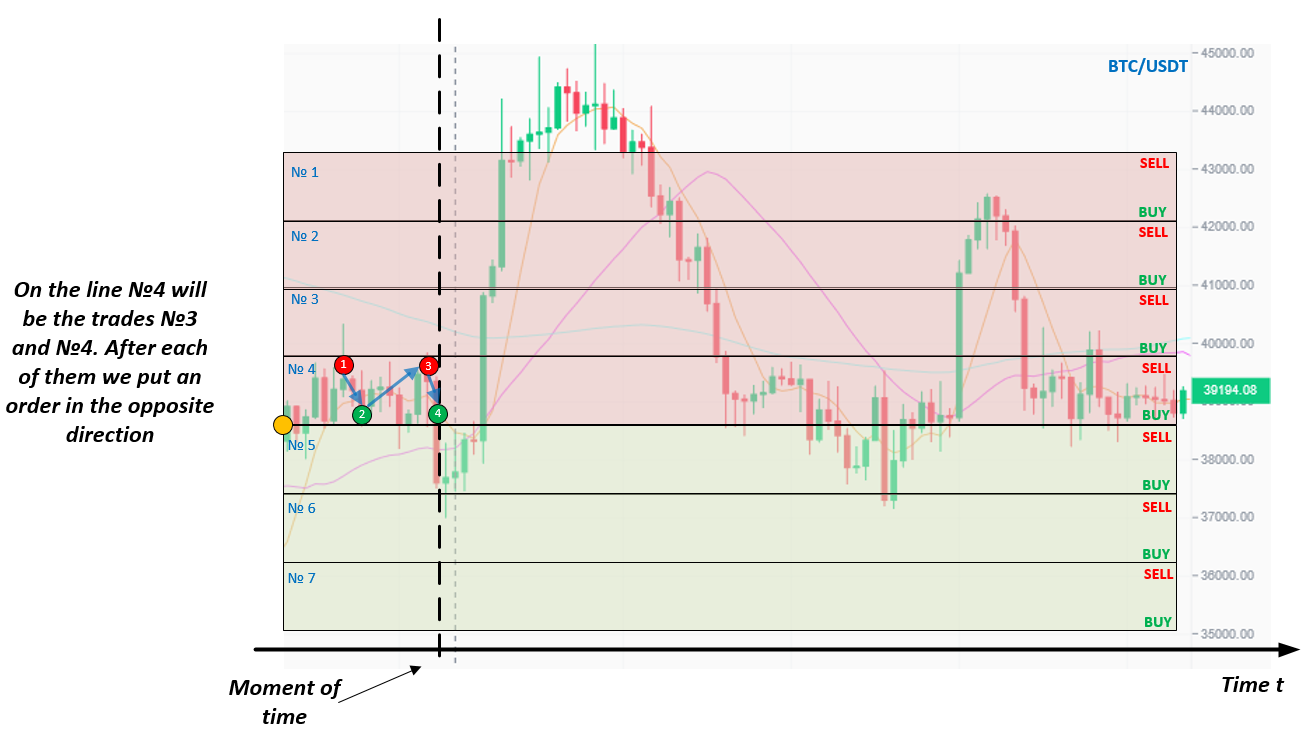

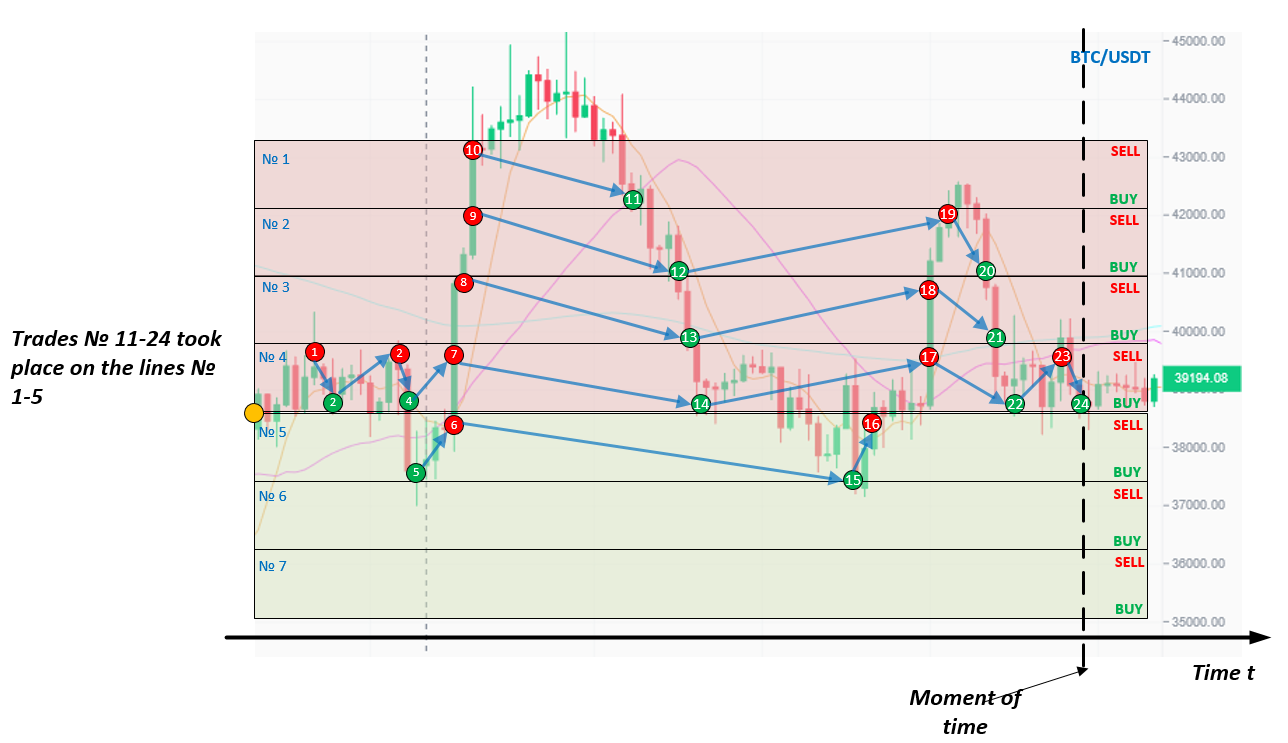

Let's simulate the rate change over time according to the above chart in order to determine the points where the trades will be registered. The dotted line shows the moment of time for which the actual trades are displayed.

Trades are formed at the points of intersection of grid lines and rate candlesticks, if it corresponds to the order (SELL or BUY)

The trade №1:

The trade №2:

The trades №3-4:

The trades №5-10:

The trades №11-24:

Thus, continues until the decision is made to stop trading on this trading symbol. As you can see, each line works independently of the neighboring ones and the number of paired trades, and accordingly the profitability of each line will be different.

Trading grid parameters

The grid can be characterized by the following parameters:

- The width of the grid is the coverage of rate fluctuations. It is usually expressed as a percentage of rate fluctuations relative to the entry point.

- Step of the grid is the difference in the buying rate and the selling rate of each row of the grid. It is usually expressed in %.

- Volume of a step is the amount of trade on the step of the grid. It is usually expressed in absolute values (USDT, BTC, ETH...).

- Number of steps - the ratio of the grid width to the step size of the grid.

It is important to understand that the Number of steps is related to the volume of the step, because the entire starting capital must be divided by the number of steps to cover the grid.

In addition, the step size of the grid must take into account the trading fee of the exchange and be greater than the double fee (you need to buy and sell - two trades, respectively will be paid double fee). For example, if the commission is 0.2%, then the step must be greater than 0.4%.

The step size also affects the number of trades - the smaller is the grid step, the more trades will be performed on it, but each of them will be less profitable.

The volume of each row of the grid directly affects the profitability and it can be determined in different ways. Here are the most common variants:

- Evenly (the whole sum is divided equally by the number of steps)

- Not evenly - the sum is divided either from the prerequisites of growth or fall of the rate. In general, you can come up with quite a lot of strategies to divide the sum.

State of the trade grid

In general, it is important to distinguish between two states of the trading grid:

- Working - when the current rate is within the working grid lines

- Not working - when the current rate is above the uppermost grid line or below the lowest grid line

Funds reserving

At the beginning of trading it is necessary to understand how the problem of the grid going out of order, which will happen to any grid sooner or later, will be solved. If the expansion of the grid is planned, it is necessary to provide for the reserve funds for new orders. The reserve funds do not participate in trading and do not generate profits in any way, so you should be careful with the size of the reserves and how it is distributed. In general, we can recommend the following approaches:

- Involve about 30% of the funds at the start of trading

- Monitor the state of the grid

- If the grid goes out of working condition, and you do not want to finish the trade, take a pause in 2-3 days before extending the grid, because the rate can come back.

- Not to expand the grid, if the rate moved no further than 2 grid lines and not more than for 3 days.

- Build up the grid in one direction only and expand as needed - this is generally more profitable, but more time consuming

- Allocate reserves to other symbols or add funds to existing grid lines if not used for a long time

Modification of the trading grid

In life, it is often necessary to replenish the exchange balance with the released funds. It is also possible to divide them by different methods (evenly, up the grid, down the grid, strengthen the weakest lines, strengthen the most active lines according to statistics and others).

It is also allowed to gradually expand/decrease the grid over time. Such an adaptive trading grid will bring more income, because more funds will be involved in trading. In any case it is always a balance between risk and profitability.

Extreme (degenerate) grid variants are possible, for example, from one line - there will be maximal capital capacity on the line, but this capital will not work in case the rate leaves its limits.

There is an approach of gradual filling of the trading grid, which does not exclude the construction of a "gap" grid, when there are gaps with non-working lines. It is justified, when the rate changes strongly and remains at a new level for a long time. This approach allows you to return the grid to the working condition without taking losses.

We recommend to pay attention to the approach of gradual filling of the trading grid from the very beginning, when not all funds are invested in the grid, but, for example, half of them. When the grid is out of working condition, use the remaining funds to return the grid to working condition.Exit point

When formulating a trading strategy, it is important to understand when to evaluate trading results and take profit. The chosen parameters of the trading grid and the trader's actions depend on it. Each trader chooses this parameter for himself. The target currency is also important (increase USDT or BTC) - this affects the evaluation of profitability at a particular moment in time. Of course, it is necessary to exit the trade at the moment of an acceptable rate of the target currency.

The exit can be full or partial. The full exit consists in cancellation of all active orders. The partial exit can be various:

- Complete cancellation of orders of all grid lines and creation of a new grid (possibly with fundamentally different parameters)

- Even decrease of the row orders by % or absolute value

- Unequal decreasing of orders of a gridline by choice (the least effective, the most profitable, etc.)